Real estate and stocks are both excellent investment vehicles, but each has its own set of advantages and disadvantages. Here are some of the key differences between them: Liquidity. Risks. Location. And Profits. Real estate investing may be a better option if you're looking for passive income streams over the long-term. Real estate can also offer a passive income stream, as well as substantial appreciation. Stocks, on the other hand, are subject to market, economic, and inflation risks. Although stocks can be bought or sold quickly, they do not require large cash investments.

Profits

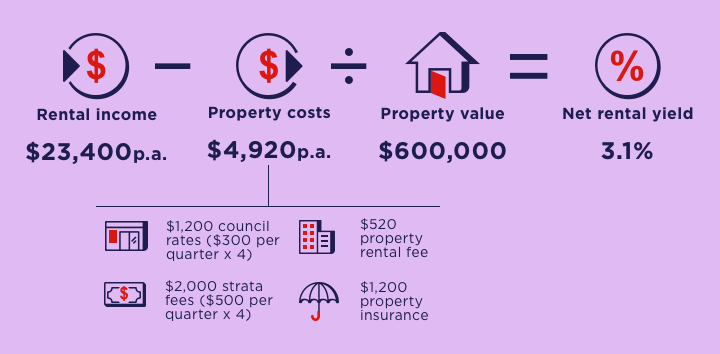

There are many benefits to real estate investments. For starters, real estate can create cash flow. Cash flow is money left over after expenses have been paid. You can offset your expenses by renting income. This will put money in the pocket. Your cash flow will improve the longer you own a property. Additionally, you can take advantage of a variety of tax breaks and deductions for real estate. These tax deductions include deductions for reasonable expenses relating to operation or ownership.

Real estate investment offers flexibility, which many investors want. You can gradually build a portfolio and use the rental income to supplement your income. You can also use the fix-and-flip profits as your main source of income. Real estate also gives you freedom and flexibility to manage your property around your schedule. You're your own boss. No one can dictate your hours or limit your salary when you work in this field.

There are always risks

It is important to know the differences between stocks and real estate investing. Real estate is a much more stable investment than stocks. The risk of capital loss is much lower with real estate, as the land you own serves as collateral for your initial investment. Stocks on the other side are more liquid and you can cash out anytime. Dividends are another way stocks can earn income. However, investors need to be aware of volatility in stock prices as this can affect emotional decisions.

In addition to being higher risk, you will have to wait for your return to see a positive impact. Stocks are able to return 10% annually, but real estate can return three to four percent. You will still see a 20% annual return if you have at least 20% equity in the property. This is far more than what you would get from stocks. You may also find it difficult to find properties of good value and then sell them at a lower price than what you paid. If you sell your property in a very short time, you may face a tax penalty that is equal to the average return on the real estate industry.

Liquidity

Liquidity describes the ease with which investors can convert their investments into cash. Stocks are more liquid and can be sold at regular market hours. While it may take a few days to sell an entire position in stocks, investors can get their money when they want. Real estate investments, on the other hand, are more liquid and may not appreciate as quickly as stocks.

Another benefit to investing in real estate is that the income generated from it is more than capital gains. This makes it much easier to automate. The income component also automatically increases with inflation. Investors can therefore spend their real estate profits more quickly. Another benefit of real estate investing is that it is less volatile, meaning that withdrawals are more secure and less likely to be affected by short-term volatility. No matter what your preferences are, there is a strategy to suit you.

Location

Direct investment in real estate isn't for everyone. However, if you want to build a balanced portfolio, you should consider real estate along with stocks. The stock market is easy and simple to navigate. Investing in real estate is also less risky than stock index funds. Here are some tips to help make informed decisions about real estate investing.

FAQ

What is the average time it takes to sell my house?

It all depends on several factors such as the condition of your house, the number and availability of comparable homes for sale in your area, the demand for your type of home, local housing market conditions, and so forth. It can take from 7 days up to 90 days depending on these variables.

Can I afford a downpayment to buy a house?

Yes! Yes! There are many programs that make it possible for people with low incomes to buy a house. These programs include government-backed loans (FHA), VA loans, USDA loans, and conventional mortgages. For more information, visit our website.

What are the benefits associated with a fixed mortgage rate?

Fixed-rate mortgages lock you in to the same interest rate for the entire term of your loan. You won't need to worry about rising interest rates. Fixed-rate loans have lower monthly payments, because they are locked in for a specific term.

How much does it cost for windows to be replaced?

Windows replacement can be as expensive as $1,500-$3,000 each. The total cost of replacing all of your windows will depend on the exact size, style, and brand of windows you choose.

Statistics

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

External Links

How To

How to become real estate broker

Attending an introductory course is the first step to becoming a real-estate agent.

The next step is to pass a qualifying examination that tests your knowledge. This means that you will need to study at least 2 hours per week for 3 months.

You are now ready to take your final exam. To be a licensed real estate agent, you must achieve a minimum score of 80%.

If you pass all these exams, then you are now qualified to start working as a real estate agent!